Call free today

IVA is short for Individual Voluntary Arrangement and is one way that you can manage a debt that you’re struggling to repay and avoid defaulting on your loans.

Available in England, Wales, and Northern Ireland, individual voluntary arrangements allow you to make regular payments to cover all or part of your debts. Typically, these are made monthly for between five and six years and are based on the amount you can reasonably afford to pay without wiping out all your disposable income.

Not only can an IVA help you manage your debt, but they can also offer more control than bankruptcy and allow you to continue running a business if you own one. And, once you’ve entered one, an IVA will legally protect you from being pursued by your creditors.

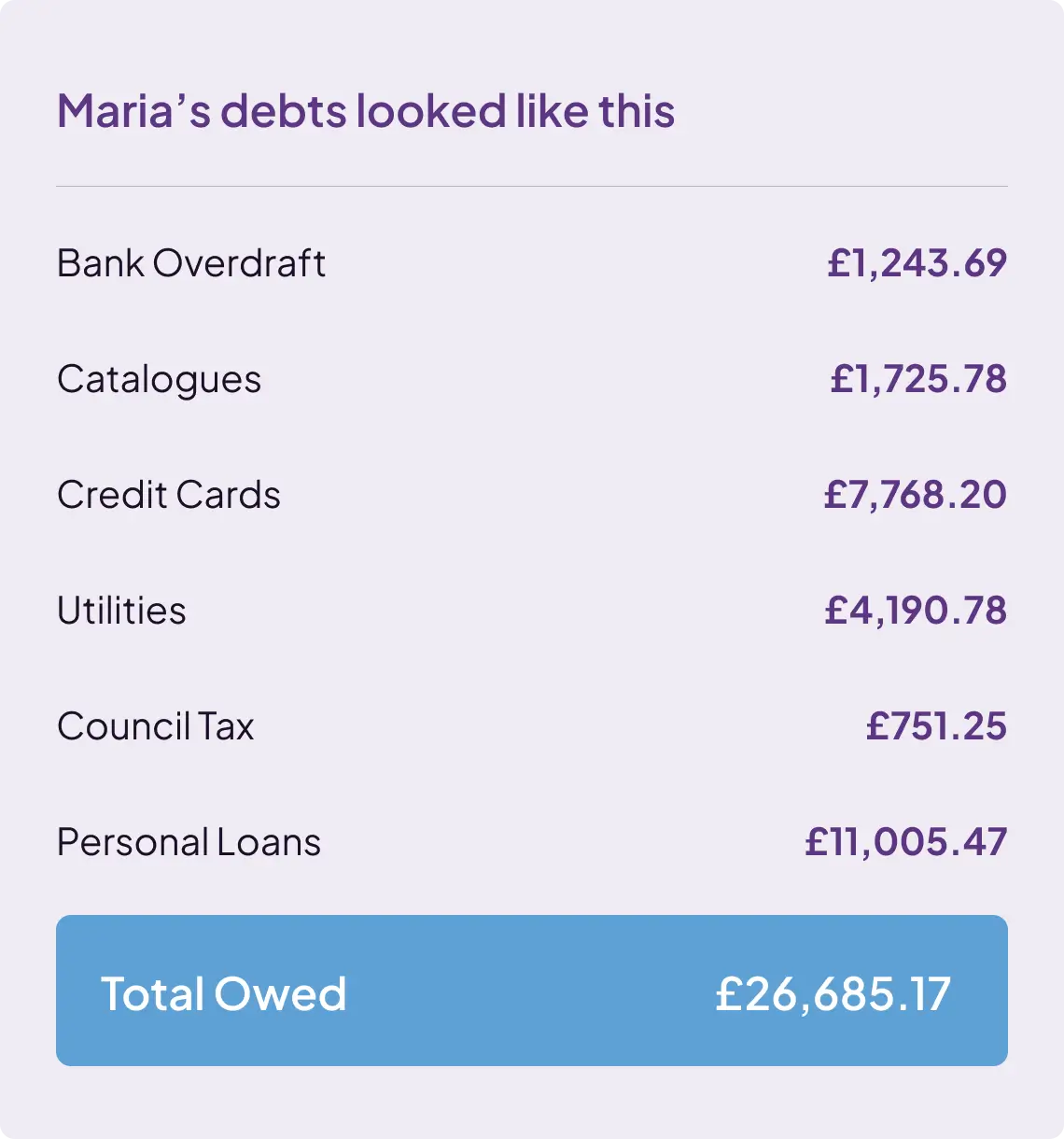

Not everyone is eligible to enter an IVA. You’ll usually need to have at least three different creditors and a large amount of debt, but also show that you have a long-term source of income that allows you to pay something back each month. Individual voluntary arrangements can only be used to help pay for certain types of debt. These include overdrafts, personal loans, Council Tax arrears, hire purchase arrears, credit and store cards, mortgage shortfalls, and any money owed to HMRC.

If you’re looking for IVA advice or to set up an arrangement, you’ll first need to find an insolvency practitioner. These are qualified professionals – often lawyers or accountants – that act as a go-between for you and your creditors. It’s their job to work out exactly what you can afford to repay towards your debt and how long the IVA should last. That means that you’ll have to share details of your financial situation with them including your assets, income, and list of creditors, so it’s important that you find an insolvency practitioner you can trust. Some practitioners work independently while others provide IVA debt help through a debt management company. Your insolvency practitioner will contact your creditors on your behalf. The creditors holding 74% of your total debt will have to agree to the IVA and, if they do, it will apply to everyone you owe. Individual voluntary arrangements are formal, legally binding, and approved by the court. Once up and running, you’ll make each payment to your insolvency practitioner, and they’ll divide the money between your creditors.

VA costs are charged for the preparation of your proposal and the administration of the arrangement for the full term (usually 5 years) these costs are charged from the monthly contributions you make into the IVA and are not in addition. Costs will only be recovered on approval of your arrangement and once you commence making payments to it. The fees for preparation of the proposal to creditors and calling the meeting for creditors to vote on its approval are called nominees fees, the fees for running the arrangement once approved are called supervisors fees. There are also some expenses incurred in the running of the arrangement such as the registration fee and the statutory insurance that needs to be taken by law, these are called disbursements. For our arrangements, the total of all of these is £3,650 although this may be adjusted by creditors when they vote on whether to accept. No matter what the end total of costs come to, you can be rest assured that these will be taken from the monthly payment we agree with you.

Your IVA will be added to the Individual Insolvency Register but this will be removed three months after the agreement ends. Even so, it will remain on your credit report for six years and may impact your chances of securing future loans. If you reach the end of the individual voluntary arrangement and have kept up with your repayments throughout then, even if you haven’t covered the original debt in full, you won’t have to pay any more unless you get a windfall. In that case, this additional money can be taken to pay your creditors, even if the IVA is over. It’s also worth bearing in mind that the IVA can be cancelled by your insolvency practitioner if you don’t make all the payments, and this can lead to bankruptcy.

*Monthly payment based on individual financial circumstances

*Example is based on period of 60 months. *Credit rating may be affected, and fee may apply. *Subject to creditor acceptance

All fees paid are charged from the monthly contributions you make into the IVA and are not in addition.Costs will only be recovered on approval of your arrangement and once you commence making payments to it. The fees involved are:

For an IVA arrangement with My Debt Plan, the total of all of these fees is £3,650 although this may be adjusted by creditors when they vote on whether to accept. No matter what the end total of costs come to, you can be rest assured that these will be taken from the monthly payment we agree with you, and you won’t notice these fees being taken at all.

If your IVA is terminated because e.g. you have failed to pay all the agreed IVA payments, it is likely that the majority of the contributions you have paid will have been used to pay the costs and expenses of your IVA. This will mean that the amounts you owe to your creditors will have reduced by very little. Your creditors will again be able to claim the amounts you owe to them together with interest and charges

An IVA (Individual Voluntary Arrangement) is a formal debt solution that allows you to make reduced payments towards your debts over a fixed period, usually five to six years. It’s a legally binding agreement between you and your creditors.

If you’re struggling to afford the IVA fees, it’s important to discuss your concerns with your insolvency practitioner as soon as possible. They might be able to make adjustments or provide guidance on alternative solutions.

No, reputable insolvency practitioners My Debt Plan are transparent about their fees. All charges associated with the IVA will be clearly outlined in the agreement, and you should have a clear understanding of what you’re paying for.

Absolutely. Reputable insolvency practitioners will provide you with a detailed breakdown of all fees associated with the IVA. This breakdown should be clear and easy to understand.

An Individual Voluntary Arrangement (IVA) is a formal agreement with creditors to repay a portion of your debts over time, but it does have an impact on your credit score and it will be difficult to obtain further credit whilst on an IVA. Once an IVA is approved, it is recorded on your credit report and will typically remain there for six years from the date it starts.

However, it’s important to note this is the case for most debt solutions and your credit score will likely already have been affected by being in debt in the first place.

Once your IVA is complete you will get a fresh start to begin rebuilding your credit rating.

IVA costs are charged for the preparation of your proposal and the administration of the arrangement for the full term (usually 5 years) these costs are charged from the monthly contributions you make into the IVA and are not in addition. Costs will only be recovered on approval of your arrangement and once you commence making payments to it. The fees for preparation of the proposal to creditors and calling the meeting for creditors to vote on its approval are called nominees fees, the fees for running the arrangement once approved are called supervisors fees. There are also some expenses incurred in the running of the arrangement such as the registration fee and the statutory insurance that needs to be taken by law, these are called disbursements. For our arrangements, the total of all of these is £3,650 although this may be adjusted by creditors when they vote on whether to accept. No matter what the end total of costs come to, you can be rest assured that these will be taken from the monthly payment we agree with you.