Call free today

Reduce your monthly outgoings and take control of your debts with an IVA

Complete our online form or give us a call and our friendly advisors will help you without any judgement.

Dependant on your circumstances and financial situation, we'll let you know if an IVA is a potential solution for you.

If you qualify for an IVA, we will take the necessary steps to set up and arrange this for you.

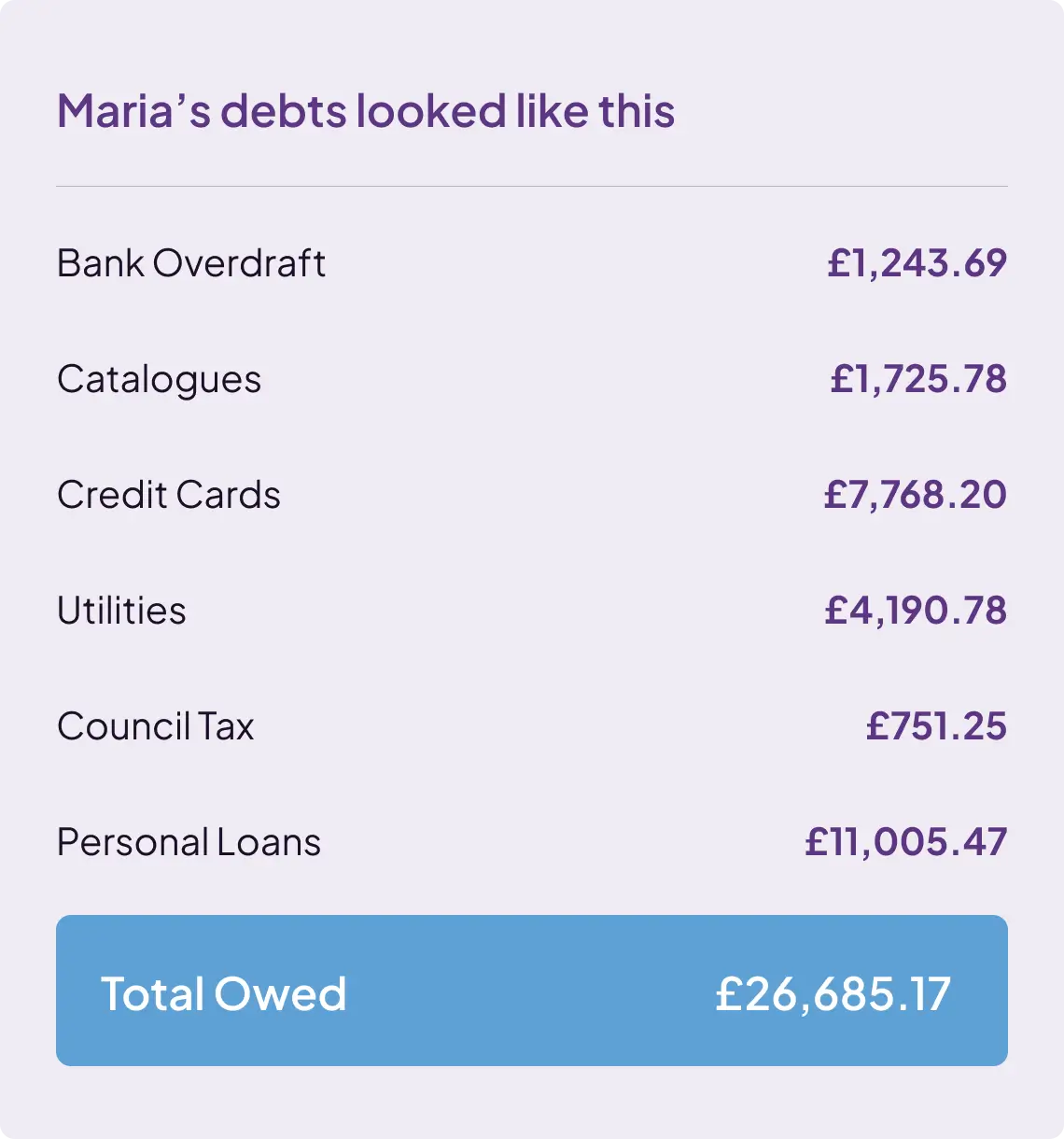

An individual voluntary arrangement (IVA) is a formal agreement between you and your creditors. It is a fixed-term debt plan that legally protects you from your creditors. An IVA freezes interest and cuts your monthly repayments to an affordable level. Better yet, any debt left unpaid when the term finishes is written off. The exact amount of your monthly payment will depend on your circumstances but can start from as low as £70.

At My Debt Plan, we change lives and help people with significant debt by offering honest and personalised debt support, whilst providing the highest quality of service.

*Monthly payment based on individual financial circumstances

*Example is based on period of 60 months. *Credit rating may be affected, and fee may apply. *Subject to creditor acceptance

Speak to us for confidential debt help. Our friendly, experienced advisors are ready to take your call and help you with any advice you need.

An Individual Voluntary Arrangement (IVA) is a formal agreement with creditors to repay a portion of your debts over time, but it does have an impact on your credit score and it will be difficult to obtain further credit whilst on an IVA. Once an IVA is approved, it is recorded on your credit report and will typically remain there for six years from the date it starts.

However, it’s important to note this is the case for most debt solutions and your credit score will likely already have been affected by being in debt in the first place.

Once your IVA is complete you will get a fresh start to begin rebuilding your credit rating.

IVA costs are charged for the preparation of your proposal and the administration of the arrangement for the full term (usually 5 years) these costs are charged from the monthly contributions you make into the IVA and are not in addition. Costs will only be recovered on approval of your arrangement and once you commence making payments to it. The fees for preparation of the proposal to creditors and calling the meeting for creditors to vote on its approval are called nominees fees, the fees for running the arrangement once approved are called supervisors fees. There are also some expenses incurred in the running of the arrangement such as the registration fee and the statutory insurance that needs to be taken by law, these are called disbursements. For our arrangements, the total of all of these is £3,650 although this may be adjusted by creditors when they vote on whether to accept. No matter what the end total of costs come to, you can be rest assured that these will be taken from the monthly payment we agree with you.