If you’ve been reading IVA debt reviews, you’ll know they’re a mixed bag. Some people praise the process as life-changing. Others feel let down, misinformed, or stuck in an agreement that no longer suits their needs. When you’re dealing with serious money worries, it’s easy to be swayed by either end of the spectrum. That’s why looking at both the praise and the complaints can help you make a better-informed decision.

This blog breaks down what the most common IVA complaints really mean. We’ll explore where the process works, where it fails and what to ask before you commit. If you’re searching for debt advice or looking for the best solution for your circumstances, this is the honest take no sales rep will give you.

What Are IVA Debt Reviews Really Telling Us?

At face value, reviews might just seem like stories from strangers, however, read enough of them and patterns start to appear. People are often pleased at the start of the process, relieved to stop creditor calls, to have a clear payment plan and to feel like there’s a way out. That’s the appeal of an individual voluntary arrangement, it turns chaos into control.

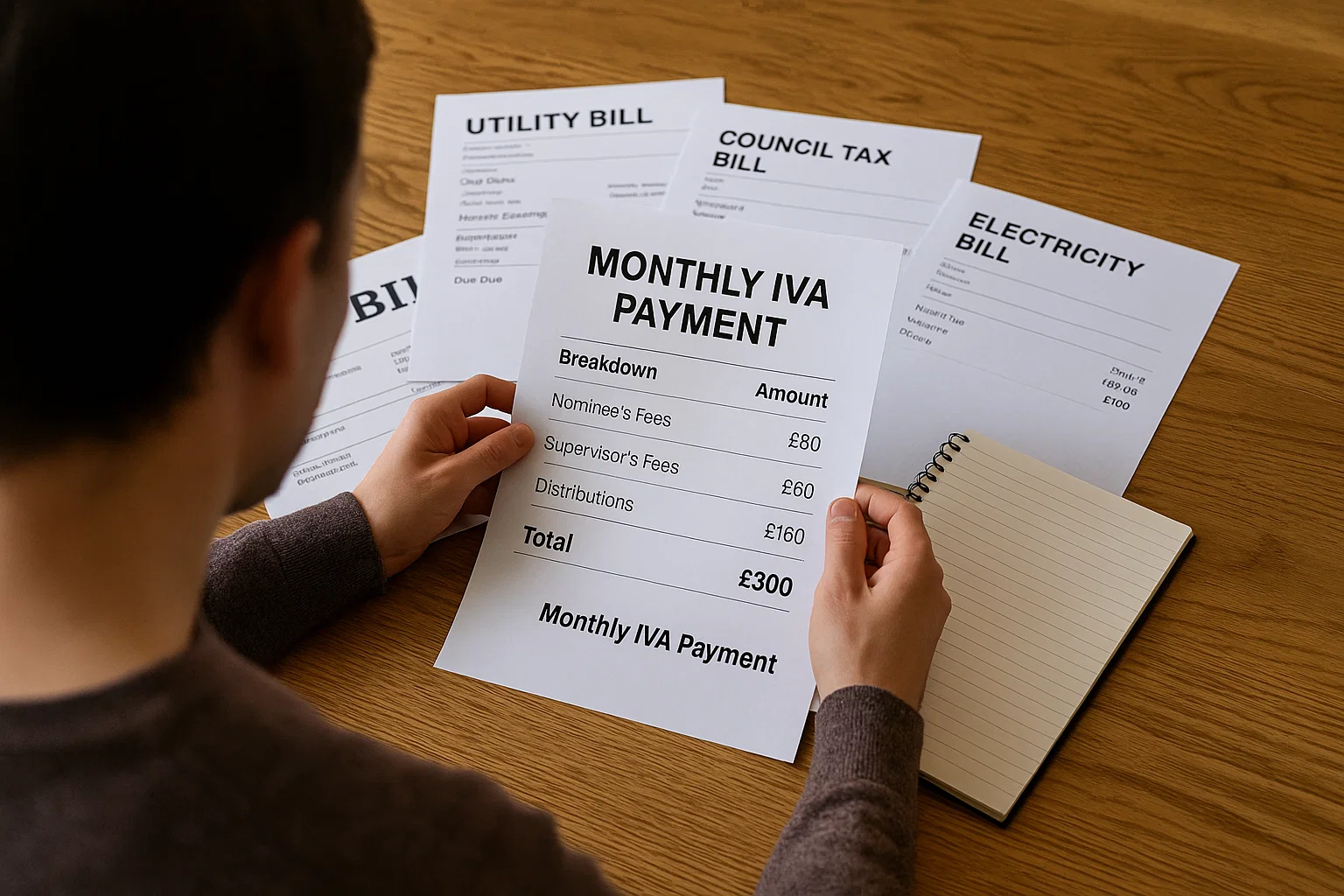

However, many complaints start to surface one or two years in. People begin to feel trapped by fixed monthly payments, especially if their financial situation changes. Some say they didn’t fully understand how strict the spending rules would be. Others are surprised to learn that their credit file and credit rating would take such a long hit. These issues don’t always reflect bad providers, they often point to rushed decisions or poor explanations early on.

Are People Mis-Sold IVAs?

This is a serious concern that crops up again and again in critical reviews. Some users say they weren’t shown all the alternatives. Others say they felt pushed into signing, only to realise later that a debt management plan or another debt solution would have been a better fit.

This is where impartial debt advice becomes crucial. An IVA is a legally binding agreement, not a casual fix. Once it’s approved, you can’t simply change your mind without consequences. Some reviewers claim they didn’t know about key details such as how a pay rise, a small lump sum, or the ability to release equity from a home could all affect what they repay.

These aren’t just admin details, they’re core to how the IVA works. The issue isn’t always the product, it’s how it was explained.

What If Circumstances Change?

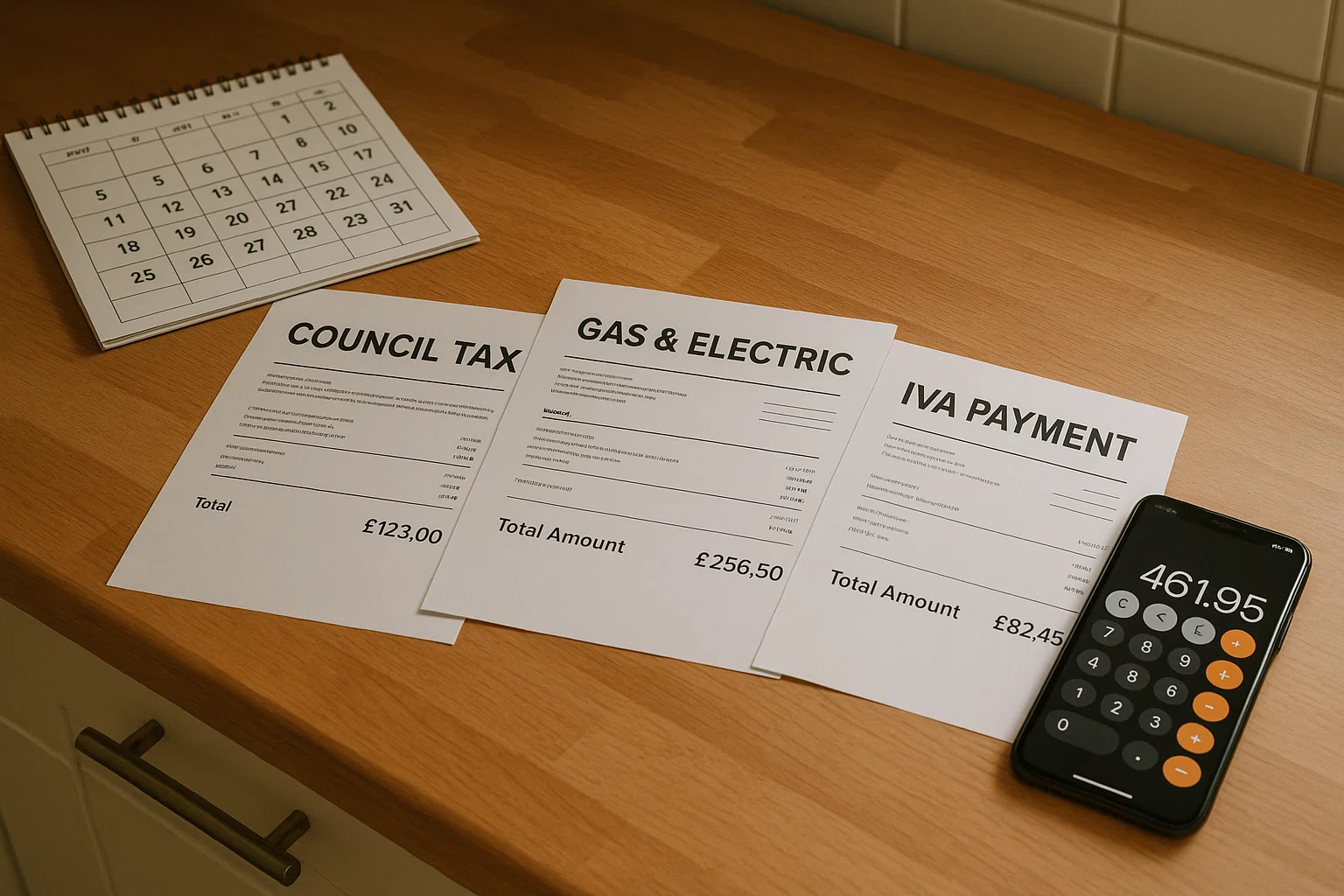

One of the biggest sources of frustration in negative reviews is a lack of flexibility. Life rarely stays the same for five or six years. People lose jobs, have children, face illness or get hit by inflation. Many of the most emotional IVA complaints come from people whose plans became unworkable but felt no one was listening.

A good insolvency practitioner will review your plan regularly and adjust where needed, but not all providers offer the same level of support. If your circumstances change and you’re dealing with a silent call centre or generic email responses, the process can feel more like a trap than a lifeline.

Reviewers often mention feeling like they were just a number, with little personalised care once the agreement was signed. If you’re reading debt help forums or Reddit threads, this theme appears a lot. It’s not always the IVA that failed, it’s the follow-up.

Are IVA Failures Common?

The phrase “IVA fails” shows up frequently in complaints. Failure usually means that payments have stopped or fallen behind, leading the practitioner to terminate the agreement. This doesn’t erase the debt, it can trigger legal action, creditor calls, or even bankruptcy.

In most cases, the IVA fails due to a breakdown in communication. Maybe the provider didn’t listen or the individual couldn’t meet payments and didn’t know help was available. Whatever the cause, it leaves people feeling abandoned.

Some reviewers suggest they were never warned how serious failure would be. Others wish they’d chosen free debt advice first from organisations like Citizens Advice or National Debtline. These services don’t profit from referring you to an IVA, so their advice tends to be more neutral.

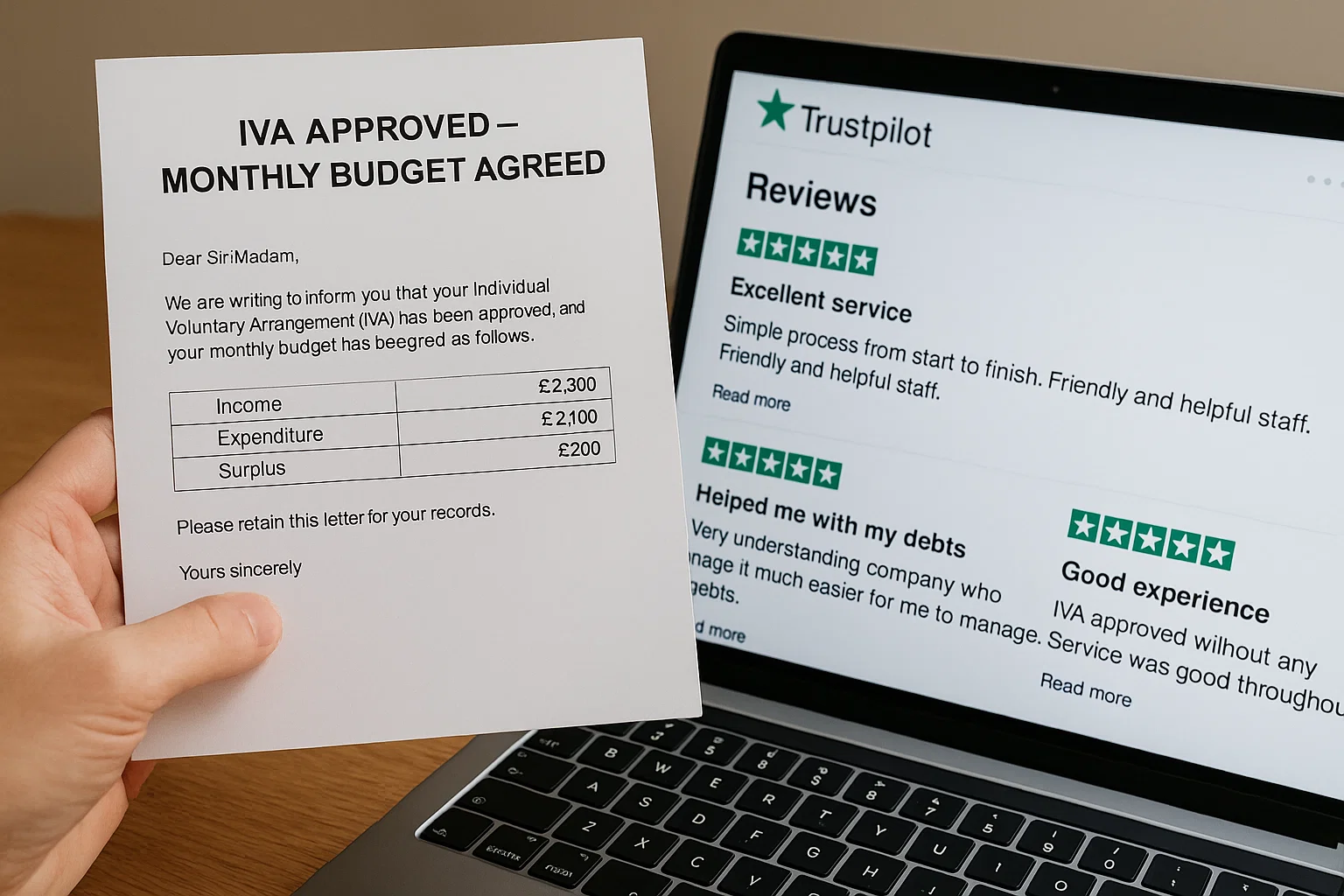

Do Any Providers Come Out Well?

Yes, and that’s important to remember. There are several IVA firms with glowing reviews and long-standing reputations. The best ones tend to offer access to a named debt adviser, explain the process in plain English and give you time to decide. This is something we provide at My Debt Plan.

Positive reviews often highlight how quickly things were set up, how much stress was lifted once creditors stopped contacting them and how professional the support team was during the setup phase. People appreciate being treated like a human, not just a debt case.

Even the best providers have the occasional one-star review. That’s why it’s important to read a wide range, not just the glowing testimonials on the provider’s own site.

Should You Trust Review Sites?

Review platforms like Trustpilot or Feefo can be useful, but they’re not perfect. Some firms have entire teams dedicated to boosting scores, others might suppress critical feedback through reporting systems. You also need to look beyond the number of stars, the content of the reviews matters more than the average.

Look for signs of transparency. Make sure to check reviews that mention real names and the problems are addressed publicly by the provider. You’d also like to see the company respond to negative comments rather than just ignore them. If you’re trying to get tailored advice based on real-life experiences, read long-form reviews rather than just star ratings.

What Questions Should You Ask Before Signing?

The main complaint in negative IVA reviews is usually: “I didn’t know that.” Whether it’s about the impact on your credit file, the length of the plan, or what happens if you change jobs, surprises are rarely good. Asking the right questions early can save you years of regret.

Some good ones include: What happens if I lose income? Who handles my account after the IVA is set up? Is this the only option available? What happens if I get a bonus or inheritance? Is this IVA proposal based on all the alternatives?

Don’t be afraid to pause and reflect as a reputable firm won’t rush you. If you feel pushed, take that as a red flag.

Are Sole Traders Affected Differently?

Many people don’t realise that sole traders can also enter IVAs. Some reviews from business owners mention confusion over how the process affects their trading accounts, tax returns or business expenses. If you’re self-employed, you’ll need even more clarity about how your IVA will be calculated, especially if income is unpredictable.

A good debt adviser will flag this early and include these details in your agreement. If they don’t, your IVA could collapse later due to under-declared income or disputes with HMRC.

Should You Use an Online Tool to Compare IVA Providers?

There are more online tool platforms than ever and many are helpful. They let you compare firms by reviews, services and accreditations, however they’re not all impartial. Some earn a commission for every referral, even if they claim to offer impartial debt advice.

If you use a comparison site, double-check that the provider is properly regulated. Look them up on the insolvency register, check their licensing status and search their name along with phrases like “reviews” or “complaints” to see what comes up.

The Role of Free, Independent Support

If you’re unsure, speak to a debt adviser at a non-profit organisation. Services like Citizens Advice and National Debtline can help you weigh up whether an IVA is the best solution, or if another approach would better suit your needs. They’re particularly helpful if you’re not sure whether you qualify, or you want a second opinion.

While the appeal of a quick fix is strong, real debt help comes from advice that matches your life, not just your paperwork. Don’t let stress or embarrassment push you into the first solution you’re offered. There’s always time to stop, research and ask questions.

Last Word: Look Beyond the Stars

IVA debt reviews can be powerful but only if you know how to read them, look past the rating and into the story. Is the person complaining about the IVA, or how it was explained? Are they warning you about the product or the provider?

The real message in most complaints is clear – people want to feel heard, supported and properly informed. If you’re considering an IVA, start with that. Ask for advice that’s based on your actual situation and above all, make sure the decision is yours and not something you feel backed into.

The goal of an IVA is to give you control and at My Debt Plan, that’s exactly what we do.