Still, as with all things financial, it is wise to proceed with caution and understand the implications of all the debt solutions available to you before you put pen to paper.

A single monthly debt payment can be a stress-free solution. Still, it isn’t for everyone, so before you commit to any changes, seek financial advice from a licensed financial advisor and make the moves that will help to set you on the road to financial success.

What Does a Single Monthly Payment Mean?

Juggling credit card debts, loans, store cards, and overdraft repayments can get confusing when you have multiple debts, and it’s doubly stressful when your income doesn’t stretch that far.

A single monthly payment is an attractive idea as it could go a long way in resolving the problem. It’s easier to remember how much to pay and when, and budgeting becomes much simpler. A single monthly debt payment means bringing your unsecured debts into one affordable monthly repayment, usually through a consolidation loan, Debt Management Plan (DMP), or an IVA. Each month, you pay an agreed amount, and you’re done until the next payment falls due. In plans such as DMPs or IVAs, the debt management organisation distributes the paid amount among the creditors.

There are several ways to achieve a situation where you pay a single monthly payment, but you have to understand your options and ensure you will benefit from the changed circumstances.

The debt payment amount must be based on what you can afford after paying essential living cost such as your rent, utilities, food and travel cost. The success of any single-payment solution depends on making steady progress to a life where your debt is easier to manage. The process shouldn’t overstretch your income as you strive to meet monthly debt repayments.

The Advantages of a Single Monthly Payment

A single monthly debt payment can bring you several benefits, especially if you’re feeling the stress of trying to pay many creditors different amounts on different dates. Advantages include:

• Easier Management: Paying differing, and perhaps changing, amounts to several creditors can get confusing. You’ll find it so much easier to pay a single set amount on the same date each month. A fixed debt payment amount makes budgeting so much easier.

• A Known Fixed Term of Payment: When you consolidate debt with the right solution, you will usually have to pay it over a fixed period. There is a clear end date, so you know exactly when you’ll reach debt-free status.

• Lower Interest Potential: If you qualify for a consolidation loan in the UK and have a good credit score, you may be able to secure a lower interest rate than you currently pay on your credit card debt or loans. This being the case, you could save money on interest.

• Reduced Stress: Making a single monthly debt payment relieves much of the stress of juggling payments and remembering who to pay and when. If you have a debt solution like an IVA or Debt Management Plan, you will also have the support of a supervisor to handle the debt directly with your creditors. With these debt solutions, the debt management organisation negotiates the payments, collects them from you, and then distributes them to your creditors. Most debtors find that relinquishing this responsibility is a major stress relief.

The Disadvantages of Consolidating Debt into a Single Payment Amount

There are also downsides to debt consolidation. These include:

• Increased Costs: A single debt payment agreement often stretches over a longer period than the original debt. This can mean that you pay more interest on the debt even if the interest rate is lower. Also, look out for upfront and debt management fees.

• Credit Score Effects: Both a DMP and an IVA will affect your credit score for a considerable time period. Even taking a consolidation loan will have a short-term effect on your score, as it will trigger a hard enquiry into your credit report.

Single Monthly Payment Options

If you’re considering a single monthly payment option, you have several choices. These include:

• A debt consolidation loan

• A Debt Management Plan (DMP)

• An Individual Voluntary Arrangement (IVA)

Let’s discuss these in more detail:

A Debt Consolidation Loan

A debt consolidation loan works as follows: You take a new loan to pay off all your current debts. Instead of having to manage several creditors and debt amounts with different due dates, interest rates, and monthly debt payment amounts, you now owe a larger amount to a single lender.

A debt consolidation loan is a popular way to address multiple creditors. Still, its success will depend on your ability to secure a loan at a reasonable interest rate. If you have been making late debt repayments or missing payments altogether, your credit score may not be what you’d like. A lower credit score will impact the interest you pay. It could even make it very difficult to get a loan. If this is the case, you may need to consider other debt solutions.

A debt consolidation loan delivers many of the benefits of a single monthly payment, along with some additional advantages:

• Boost your credit score: Paying off your existing debts with a consolidation loan can help improve your credit score over time, provided you continue making repayments on time.

• Save on interest: If you get a good deal from the lender, you could save by paying off expensive credit card debts. However, if you extend the payment period, you could pay more interest overall.

Taking out a consolidation loan brings an additional risk: if you continue to use your credit cards after paying off the balances with the loan, you could quickly find yourself in a worse position than before.

A Debt Management Plan

Debt management companies and debt management charities, such as StepChange and PayPlan, often arrange debt management plans for distressed debtors. DMPs are informal arrangements between debtors and their creditors.

If you have a DMP, you make a single monthly debt payment, and the debt management company distributes the money pro rata to your creditors. Creditors may agree to stop contacting you and may freeze or reduce interest, although this is not guaranteed.

On the downside, a debt management plan will impact your credit score. You also need to close your accounts with the creditors included in the DMP. Though many creditors will freeze interest charges, some may continue to charge interest, increasing the amount you owe.

An Individual Voluntary Arrangement

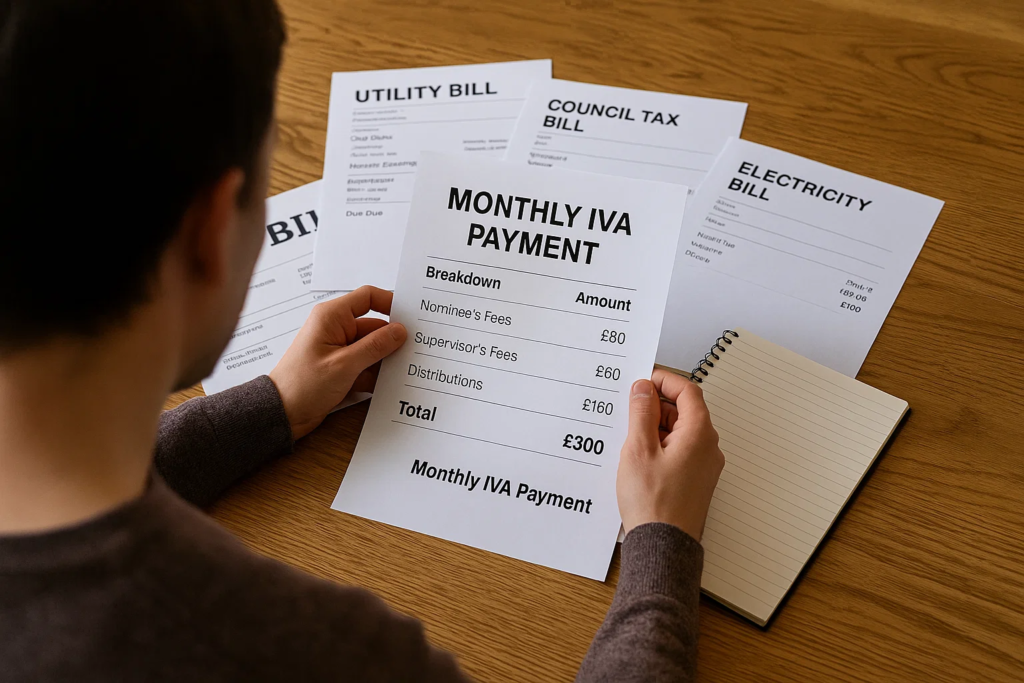

An IVA is a legal agreement between you and your creditors. It is commonly used for managing multiple unsecured debts and is arranged with a licensed Insolvency Practitioner (IP). Seventy-five percent of your creditors by value must agree to the IVA. You pay a fee for the IP’s assistance.

With an IVA, your debts are brought into a structured repayment plan, and you agree to make a monthly payment based on your income, assets, and monthly expenditure. The IP manages communications and distributes funds to creditors. Any remaining qualifying unsecured debt at the end of the IVA is written off.

The downside of an IVA is that you have declared yourself insolvent. The details of your insolvency will appear on the Individual Insolvency Register (IIR) for the duration of the IVA, usually five or six years, plus a short period after completion. The IIR is a public record, and anyone can access it. The IVA will affect your credit score for six years.

Once your IVA is approved, your creditors must stop contacting you and cannot take further legal action or add interest or charges.

When Does a Single Monthly Payment Work Best?

A single monthly debt payment works best when you can make regular monthly payments. You don’t always need a fixed salary, but you must be confident that your income covers both essential living costs and the proposed repayment.

It works well when you’re paying off several unsecured debts: managing credit cards, overdrafts, personal loans, and store cards can get confusing when they have different due dates and interest amounts. Consolidating these debts into a single payment can bring order, so you break the monthly catch-up cycle.

Many people opt for a single payment when their debts become unmanageable. You can get a much clearer picture of what you owe when the amounts are consolidated into a single value and you make a single monthly payment. It also means fewer missed payments.

You’re on the road to financial recovery. You now have a manageable debt plan that is both simple and predictable.

When Does a Single Monthly Payment Not Work So Well?

Rolling all your payments into a single monthly payment may sound like a convenient option, but it isn’t the best solution for every circumstance. It may put undue stress on you if you don’t have a predictable income – for example, if you work on commission or you’re a seasonal worker. Missing payments can worsen your financial situation.

It also won’t work if most of your debt is secured, such as a mortgage or motor finance. Secured debts cannot usually be included in these arrangements.

If your debt repayment problem is short term and the total debt is low, you may not need a formal plan. Speak directly to your creditors and try to fix the problem without affecting your credit score.

Be very careful about taking a secured loan to consolidate your debt. If you fail to make your monthly payment, you could lose the asset used to secure the loan.

If you agree to a monthly payment that is too high, you will struggle to pay. You risk missing payments, which will further damage your credit rating.

If you decide to handle your debt problem through debt consolidation and make a single monthly payment, you must reconsider your spending habits. Unless you change the way you manage money, you could end up back in the same situation.

Is a Single Monthly Payment the Best Solution for You?

A single monthly payment may be just what you’re looking for, and the good news is that you’re not alone in this. There are plenty of experienced debt counsellors who can help you. They have the experience and training to assess your current situation and find the best debt solution for you. Contact My Debt Plan and start your winning plan today.