When Gambling Becomes a Problem

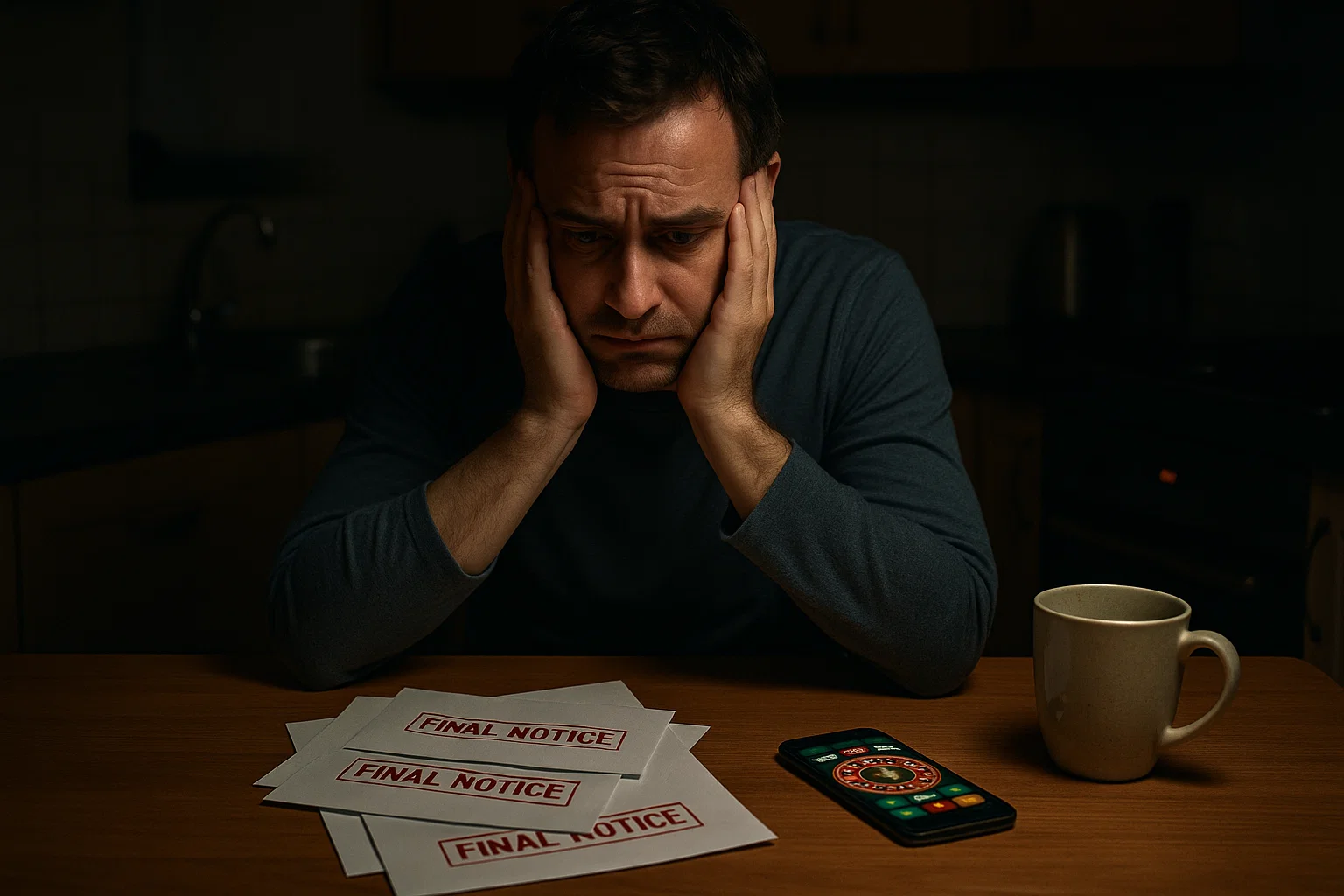

Placing a bet now and again doesn’t necessarily mean there’s an issue. The trouble starts when gambling behaviour shifts from entertainment to something that controls your life. If you find yourself borrowing money to gamble, missing essential bills, or chasing losses late into the night, those are warning signs.

Clinicians sometimes use the Diagnostic and Statistical Manual to define pathological gambling or a gambling disorder, but in everyday life the markers are often simpler. You might notice lying to your partner about spending, skipping work to play online poker, or using an overdraft to cover bets. The more gambling becomes linked to desperation for money rather than fun, the more dangerous it becomes.

Problem gambling is not only about finances. It can strain relationships, affect your mental health and trigger feelings of shame. Many people describe feeling like a compulsive gambler, unable to stop even when the negative consequences are obvious.

Gambling Debt and Mental Health

There’s a strong link between gambling problems and wellbeing. Anxiety, depression and even substance abuse or drug addiction can appear alongside gambling issues. Some turn to alcohol or drugs to numb the guilt of losses, while others gamble harder to escape stress. It’s a destructive cycle.

The good news is that recovery is possible. Talking openly about how gambling affects your mental health is an important first step. Services such as GamCare, the Samaritans, plus local support groups provide safe spaces to discuss how debt and compulsion are affecting your daily life. Gamblers Anonymous meetings can also help you connect with others who know exactly what you’re going through.

Why Talking Helps

Shame often keeps people trapped in silence. Yet the act of speaking out, whether to a trusted friend, a professional or a helpline, removes the isolation that feeds addiction. Many people find that once they admit, “I need to stop gambling,” the recovery journey begins.

Charities provide confidential and independent support. They offer a place where you can explain your circumstances without fear of being judged. The reassurance that advice given meets strict standards gives you confidence that the help you receive is reliable.

Professional Debt Advice

When debts have already piled up, seeking help from an expert debt adviser is essential. Advisers can explain which debt solutions are open to you, whether that’s a Debt Management Plan, an Individual Voluntary Arrangement (IVA), a Debt Relief Order (DRO), or in some cases bankruptcy.

An expert debt adviser listens carefully to your full situation. They’ll ask about income, arrears, credit cards and gambling losses, then show you a tailored plan. The fact that many services are delivered by a debt advice charity means you can expect discretion and practical steps rather than judgement. These organisations specialise in helping people rebuild after financial crises caused by gambling.

If you’d prefer, you can reach out to a free debt advice charity such as StepChange or National Debtline. They will give you the same level of guidance as private firms, but without charges. Knowing that support is there, completely impartial and professional, makes the process less overwhelming.

Setting Practical Barriers

Alongside advice, you’ll need tools that stop gambling in its tracks. Self-exclusion allows you to ban yourself from bookmakers or websites for set periods, ranging from six months to five years. GAMSTOP offers a free online tool that blocks access to UK-licensed gambling websites and apps.

Banks also play a role. Many now offer gambling blocks that decline transactions automatically. Some will limit ATM withdrawals or freeze your card if spending looks risky. Others give the option to set strict limits on gambling spend. Talking to your bank might feel daunting, but it ensures someone else is helping you control your access to funds.

If most of your gambling is digital, blocking software like Gamban or BetBlocker can stop you visiting betting sites altogether. These measures might seem extreme, but they work. By cutting off the opportunity to spend, you give yourself room to focus on debt repayment.

Building a Recovery Plan

Tackling gambling debt requires more than stopping the habit, it also means facing what you owe. Start by mapping your financial circumstances. Write down your income, housing costs, bills and food budget. What remains can be allocated towards repayments.

An adviser can give you tailored advice on which debts to prioritise. For example, priority debts like rent, council tax, or energy bills must be covered before non-priority debts such as credit cards. If you’ve reached the point where gambling losses mean you can’t meet basic costs, formal help may be the safest route.

The Breathing Space scheme offers temporary relief by freezing interest and enforcement for 60 days. This time allows you to work with advisers to choose a long-term option without the constant pressure of calls and letters.

Formal Debt Solutions

Depending on your situation, there are different paths forward:

- A Debt Management Plan lets you pay back what you can afford each month, with creditors often freezing interest.

- An IVA may consolidate debts into one monthly payment, with remaining balances written off after five or six years if you stick to the plan.

- A DRO is suitable for those with debts under £30,000, low income and little to no assets, wiping qualifying debts after 12 months.

- Bankruptcy is a final option for some, clearing debts but carrying longer-term consequences.

Each comes with pros and cons, which is why speaking to a debt advice charity or adviser is crucial. Their knowledge ensures you pick the solution that fits your lifestyle, family needs and income.

Support Beyond Finances

Beating gambling debt isn’t only about money. For some, recovery involves counselling, therapy, or even residential treatment programmes. These services focus on the risk factors behind gambling problems like stress, trauma, loneliness, or co-existing issues like substance abuse.

Recognising these triggers helps you build strategies to resist relapse. Whether through one-to-one therapy, group sessions, or online counselling, support exists to help you understand why gambling took hold and how to live without it.

The Benefits of Support Groups

Many people trying to recover from compulsive gambling find comfort in peer groups. Meeting other compulsive gamblers who share their stories helps reduce the sense of isolation. Hearing about different coping mechanisms, successes and setbacks can be motivating.

Support groups are a reminder that recovery is possible. They give you accountability and structure while you work through debts.

Long-Term Recovery

To truly stop gambling and beat the associated debts, it’s important to replace the habit with healthier routines. Setting a budget, engaging in hobbies and finding social connections away from gambling venues all help. Over time, the urge to gamble reduces.

Debt advisers often encourage clients to track spending daily, so any temptation to relapse is caught early. The more aware you are of your money, the less room gambling has to creep back in.

A Future Free From Gambling Debt

Living with gambling problems can feel like being stuck in a loop of chasing wins and hiding losses, but recovery is achievable. By seeking help from a debt advice charity, using tools like self-exclusion and banking blocks, plus engaging with therapy or support groups, you can gradually turn the tide.

If you’re ready to take the first step, our team at My Debt Plan is here. Our expert debt advisers offer confidential and independent support, helping you explore every option available. We provide tailored advice based on your situation, focusing on what you can do today rather than what happened yesterday. Call us on 0161 660 0411 or send us a message to start your journey.