Struggling with your finances this year? Kick-start 2023 with a plan in place to reduce your debt with our top New Year’s debt resolution tips

Reduce your non-essential spending

We know that the solution to all your money worries won’t be giving up takeaway coffees and leaving the avocados on the shelf but cutting back on some of your non-essential spending could help you get one step closer to reducing your debt. Check your last three months’ bank statements to find areas where you could cut back, look at switching suppliers for your phone contract and utility bills, and consider trying a no spend week to challenge yourself.

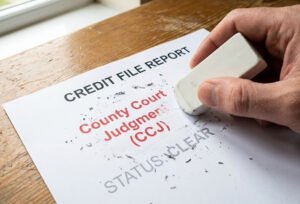

List all your debts

While facing up to your financial situation can be difficult, make it a New Year’s resolution to list all your debts out so you know exactly where you stand. Writing them all down, with the highest interest rates and monthly payments at the top, can help you identify your priority debts and make a plan. If you’re not sure that you’ve included everything, cross reference your list with your most recent credit report. Adding up all your minimum monthly payments will also show you the amount you’ll need to pay towards your debt each month to stay on track.

Stick to a budget

Starting 2023 with a workable budget – and a resolution to stick to it – could help you start to improve your financial situation and cut down your debt. The most important thing to remember when creating your budget is to make it liveable. A very strict budget with no room for small luxuries and the occasional treat might seem like a good idea at first, but it can be very hard to sustain over time. Add in extra cash for your Friday night curry or a monthly big night out and you could find it easier to maintain your budget all year.

Increase your minimum payments

If you’re making a New Year’s resolution to pay down your debts this year, start with the loans that have the highest interest rate and those that are already in arrears. When you have extra funds available – perhaps after receiving a bonus at work – you could put this money towards your credit card bill or any other type of debt with the smallest balance. While this might not seem like a priority, clearing smaller debts quickly can help you feel more in control and start paying off the rest of your debts faster.

Seek debt advice

When you’ve been trying to reduce your debts for a while but are still finding it hard to get them under control, it could be time to seek professional help. Resolve to ask for help. Start by exploring your options and you might be surprised by how much better you feel. Not only can talking to a friendly debt expert help you identify different debt management solutions and find the right option for you, but receiving impartial, confidential advice can also improve your mental health.

Set up direct debits

There are so many things to remember when it comes to your everyday finances; rent or mortgage payments, utility bills, your Netflix subscription, credit card bills, and more. It’s all too easy to forget to make a payment and end up in arrears that could damage your credit score. Make 2023 the year that you make all your payments on time by setting up automatic direct debits. That way, the money will transfer without you having to lift a finger. You might also find it even easier if you choose to set it up so that the payment to go out straight after payday.

Avoid new loans

If you’re struggling to reduce your debt, taking out additional credit could make the situation even harder. Why not decide to make your New Year’s resolution avoiding any new loans? While some loans are unavoidable, such as needing car finance if your car breaks down, reducing the number of lines of credit you have open could help you focus on your existing debts. If you can, try to avoid relying too heavily on credit cards as these can lead to further debt, especially if you fall behind with your repayments.

Resolved to reduce your debts in the New Year? Our friendly team of advisors are here to help. Give us a call on 0161 660 0411 or send a message here.