Whether you’re considering entering a debt management plan or simply curious about how they work, we’re here to help by answering some of your most frequently asked questions.

How long do Debt Management Plans last?

Debt Management Plans (DMPs) don’t have fixed terms, your agreement length will always be based on your individual circumstances.

The exact term put in place will depend on:

- How much you owe on your debts

- How much you can afford to pay towards your debts each month

If you have a lot of debt to pay but limited affordability, your DMP will last longer than it would if you had more disposable income or a lower amount of debt.

It’s also worth keeping in mind that DMP terms are flexible, which means you could make yours shorter if you get a pay rise or manage your budget so you can afford to pay more each month.

How are monthly DMP payments calculated?

DMP monthly payments are usually based on your budget.

It’s important that your DMP provider assesses your circumstances to ensure you can enjoy a reasonable quality of life for you and your family.

In a nutshell, that means you must have enough money in your budget to pay for your living expenses and essential household bills.

Any extra funds – known as disposable income – will usually need to be put towards your DMP payment.

Is a DMP legally binding?

One of the reasons why you might choose a DMP rather than a more formal debt solution like an Individual Voluntary Arrangement is that it’s not legally binding.

(Default notices will be issued even if the client continues with the DMP if they are paying less than the contractual amount on a monthly basis).

That means if you get your finances back on track and can comfortably make your debt payments or the DMP simply isn’t right for you anymore, you’re not stuck until the agreement comes to its natural end.

Be aware that you might sign an agreement with your DMP provider to give them permission to contact your creditors on your behalf.

Is a DMP a consolidation loan?

No, a DMP isn’t a consolidation loan. It’s a type of payment arrangement that can help you repay your debts on an affordable payment schedule.

A consolidation loan is a type of credit agreement that lets you pay off your existing debts with a lump sum, leaving you with just one payment to make each month on your new loan.

How will a DMP affect my credit score?

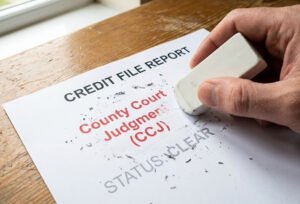

Any debt included in your DMP could have a note added, usually know as a payment arrangement or DMP flag.

These flags will be visible on your credit report so might mean creditors will be more reluctant to offer you a loan in the future.

Same as above previously mentioned, default will still show on the credit report if the client is not maintaining the contractual payments. If a debt does become a default, this can stay on your credit report for up to six years.

Can my creditors charge fees or interest during a DMP?

While some creditors might choose to freeze your interest and any extra charges during your DMP, there are no guarantees and they’re not legally required to suspend any fees.

However, in many cases, creditors understand that fees and interest can make it harder for you to pay the original debt, so they will choose to sacrifice this income to improve the chances of getting their loan repaid.

Do I need to review my DMP?

Under rules set out by the Financial Conduct Authority (FCA), your DMP provider must review your plan at least once a year.

This rule is in place to make sure that your DMP is still the best debt management solution for you and that the monthly payment amount is realistic and affordable.

Can I skip a DMP payment for Christmas or an emergency?

For emergencies such as car repairs, if evidence is provided, they can miss a payment and normally the DMP provider will inform the creditors.

In fact, these added expenses should be included in your budget before you enter a DMP. Most budgets will include funds for:

- Sundries and emergencies

- Gifts

- Savings

The best way to prepare for special events like Christmas is to use that savings line in your budget to put a little aside each month so you can splash out (within reason) when the time comes.

Will my DMP be cancelled if I miss a payment?

No one’s perfect. If you’ve missed your DMP payment date for any reason, it won’t get cancelled straightaway – even creditors understand that unexpected life events and expenses can get in the way.

If you know ahead of time that you’re not going to be able to make a payment on time, it’s best to let your DMP provider know as soon as possible.

They might be able to extend your term to accommodate the missed payment, give you advice on what might happen next, and review your budget to see if there might be a better solution for your circumstances.

Make sure missing payments doesn’t become a regular thing though as that could lead to your DMP being cancelled.

Is a DMP right for me?

A DMP can be a great option if you’re starting to struggle with debt but can still afford to put some money towards your repayments.

Signs that you’re struggling might include starting to rely on payday loans, borrowing from friends and family, making household bill payments late, or living in your overdraft.

However, it’s not the right choice for everyone.

There’s no guarantee that your creditors will agree to the DMP or pause any interest payments or extra fees that might apply.

It’s also not right for you if you’re not having problems with debt and can make your payments comfortable each month.

If you do choose to enter a DMP, it’s also important to know that your credit score could be impacted, and it might be harder for you to get a loan, credit card, or car finance deal in the future.

Considering entering a DMP? Our friendly team of experts is here to help. Give us a call on 0161 660 0411 or send a message here