The world of credit scores can get confusing, and if you’re applying for a loan or a credit card, you’d probably like to know just where you stand. You’ll find all you need to know in this guide to credit scores.

What is a credit score?

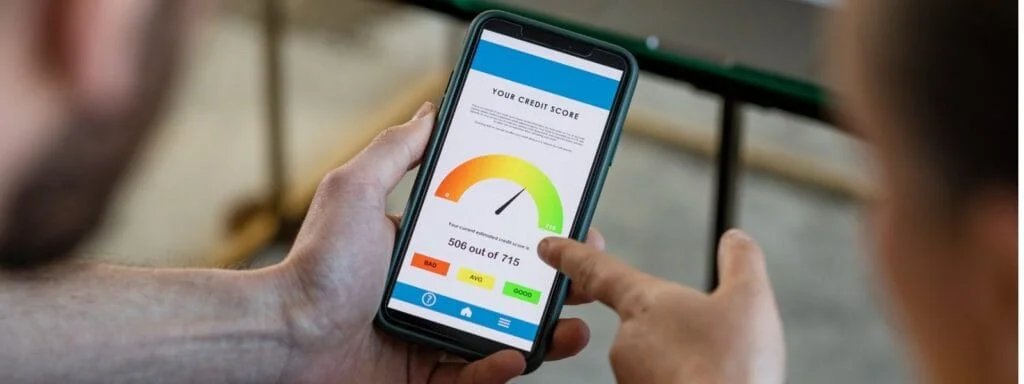

A credit score or credit rating is a measure of how well you behave as a borrower. Lenders use the credit score to assess your creditworthiness, believing that it shows the likelihood you will honour your monthly debt repayments.

Your credit score can, and often does, affect your ability to get a loan, a credit card, car finance, or a mortgage.

How do credit scores work?

Credit scores are three-digit numbers calculated by credit reference agencies. The information from your credit report is sent to the credit agencies, where it is plugged into a mathematical model. The model uses this information to calculate a number that represents your financial circumstances and your debt management skills.

Your credit score is based mainly on information such as your payment history, credit utilisation, and the length of your credit accounts. While lenders may also consider your employment and income during affordability checks, these details are not part of your credit score itself.

There are three credit reference agencies in the UK: Experian, Equifax, and TransUnion. Each uses different data and calculations to produce different credit scores. A credit score is never fixed, and your financial action and debt management will influence the direction and scale of the move.

No matter how good your credit score is, there is no guarantee that a lender will approve you for a loan. Lenders look at more than just the credit score. The good news is that even if your credit score isn’t great, you may still find a type of finance that suits your circumstances, such as credit builder products or specialist bad credit lenders.

What affects your credit score?

Credit scores aren’t an exact science, and credit reference agencies don’t disclose exactly how they calculate the score. Still, certain factors could affect whether your credit score is good, bad, excellent, or fair.

Your credit history

If you’ve missed payments in the past, have bad debt loans or regularly make late payments on your debts, it will show up on your credit report and could negatively impact your score.

Your credit types and agreement duration age

Having several types of credit agreements that you have managed well for a long time will reassure lenders that you’re a reliable borrower.

Your total debt and credit utilisation

Avoid using your credit cards to the max every month and make an effort to pay off or clear existing debt. Using less than around 30% of your available credit limit is generally considered good practice and can help improve your credit score.

Your hard credit searches

Each time you apply for a new loan or credit card, the lender does a hard search on your credit report. Other lenders can see these for at least 12 months after the search. Having too many hard searches over a short period could make lenders more hesitant to approve a loan, as they may worry that you rely too heavily on credit.

Your address history

A stable living situation gives the impression you’ll be a more reliable borrower. A long address history in one place and registration on the electoral roll could improve your credit score.

Your debt management solutions

If, in the past, you’ve struggled to make debt repayments, you may have entered a formal debt management solution such as an Individual Voluntary Arrangement (IVA), a Debt Relief Order, or you may have even declared Bankruptcy. These will appear on your credit report and could affect your score for up to six years.

How can I check my credit score?

Checking your credit report regularly is a great habit to adopt, especially if you want to improve your score.

Each of the three credit reference agencies will give you a different score. Since you don’t know which agency a lender will use, it’s a good idea to check all three.

The good news is that you can check your credit score for free. Credit Karma uses TransUnion data, while ClearScore uses Equifax data. They, along with Experian, offer a free credit check service.

You’re also legally entitled to a free statutory credit report directly from each agency’s website once a year.

If you want a more in-depth look at your complete credit report, you may have to pay a fee, although free trials are available.

Look for any mistakes or payments you don’t recognise when reviewing your score, and challenge any anomalies with the relevant credit reference agency.

Will my credit score affect my loan eligibility?

Your credit score isn’t the only thing that lenders consider, but it can affect whether you’ll receive finance approval. Lenders believe that applicants with high credit scores are less likely to miss debt payments or default on a loan. This belief may increase the chances of a high-scoring applicant getting loan approval.

A high credit score may also earn you a lower interest rate, as the interest rate reflects your perceived risk of defaulting on debt payments.

A bad credit score is more of a risk, so fewer lenders may be willing to approve you. Still, it’s not impossible to find a loan if your credit score needs some work.

What if I have no credit history?

If you’ve never had any credit before, you probably expect this to count in your favour with prospective lenders. Unfortunately, the opposite is often true. You’re an unknown without a credit history, as the lender can’t predict whether you will keep up with your debt payments. This ambiguity could make lenders more reluctant to lend you money.

Keen to find out how tackling your debts could help you improve your credit score? Our friendly team of experts is here to help. Give us a call on 0161 660 0411 or send a message here.